XSwap vs. Traditional DEXs – Why Cross-Chain is the Future of Crypto Swaps.

Decentralized exchanges (DEXs) have played a crucial role in shaping DeFi, giving users control over their assets without relying on centralized platforms. However, traditional DEXs are limited—they operate on single blockchains, creating fragmented liquidity and a frustrating user experience. XSwap changes that.

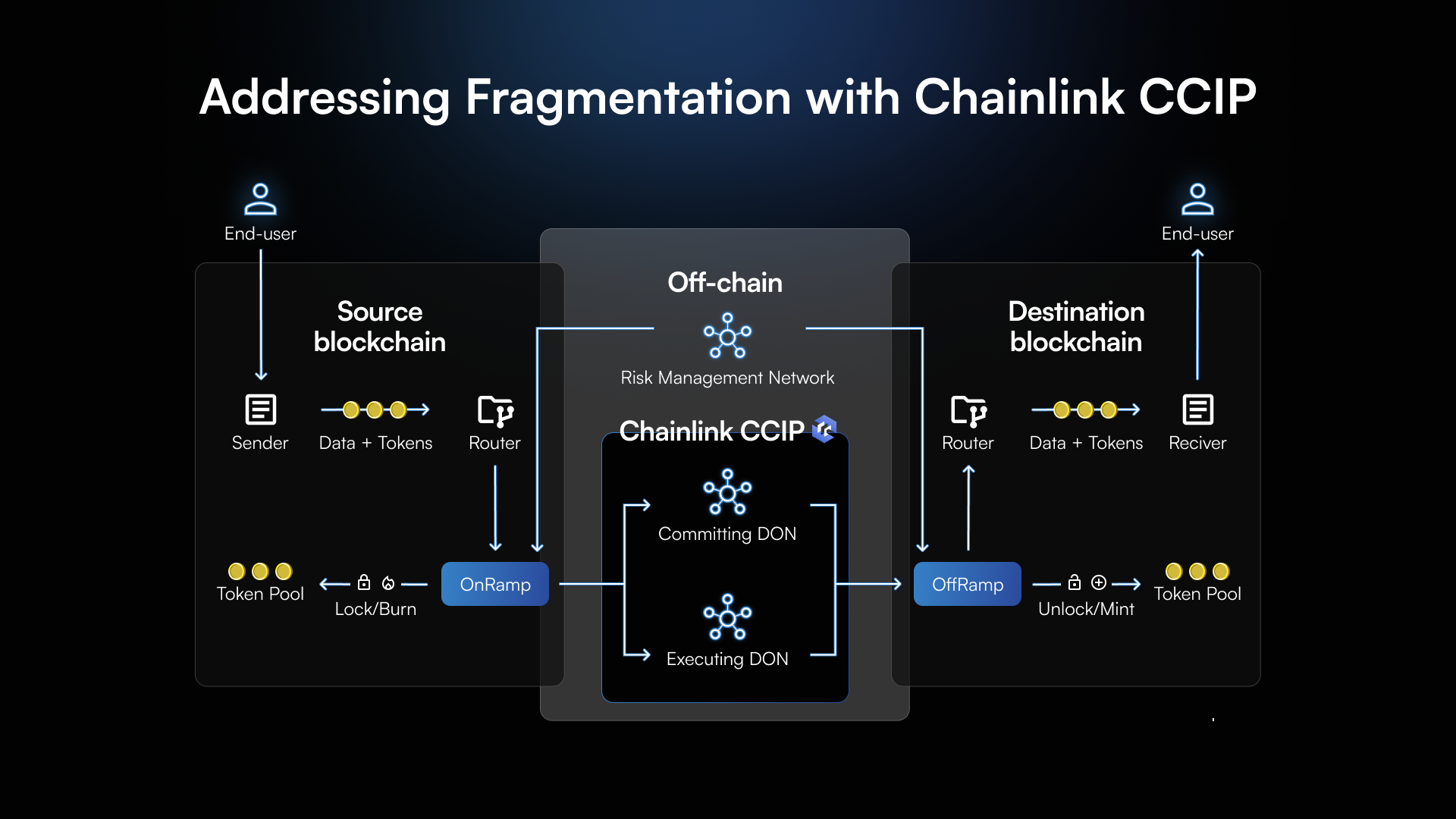

With cross-chain interoperability powered by Chainlink CCIP, XSwap allows users to trade assets across multiple networks seamlessly, solving key problems that traditional DEXs fail to address. Let’s break down why XSwap is the next evolution of decentralized trading.

1. Cross-Chain vs. Single-Chain Trading

Traditional DEXs: Stuck on One Chain

Most DEXs operate within a single blockchain ecosystem. This means if you want to trade assets across different chains, you need to use bridges, CEXs, or multiple platforms—leading to extra costs, delays, and security risks.

XSwap: True Cross-Chain Interoperability

XSwap eliminates chain restrictions by enabling swaps across networks in a single transaction. With Chainlink CCIP, XSwap ensures secure and efficient cross-chain trading, making DeFi truly interoperable and seamless.

2. Liquidity & Pricing – Aggregation Matters

Traditional DEXs: Fragmented Liquidity

DEXs on single blockchains rely only on liquidity pools within their ecosystem, leading to higher slippage and inconsistent pricing. If there’s low liquidity for a pair on one chain, traders often face poor rates and failed transactions.

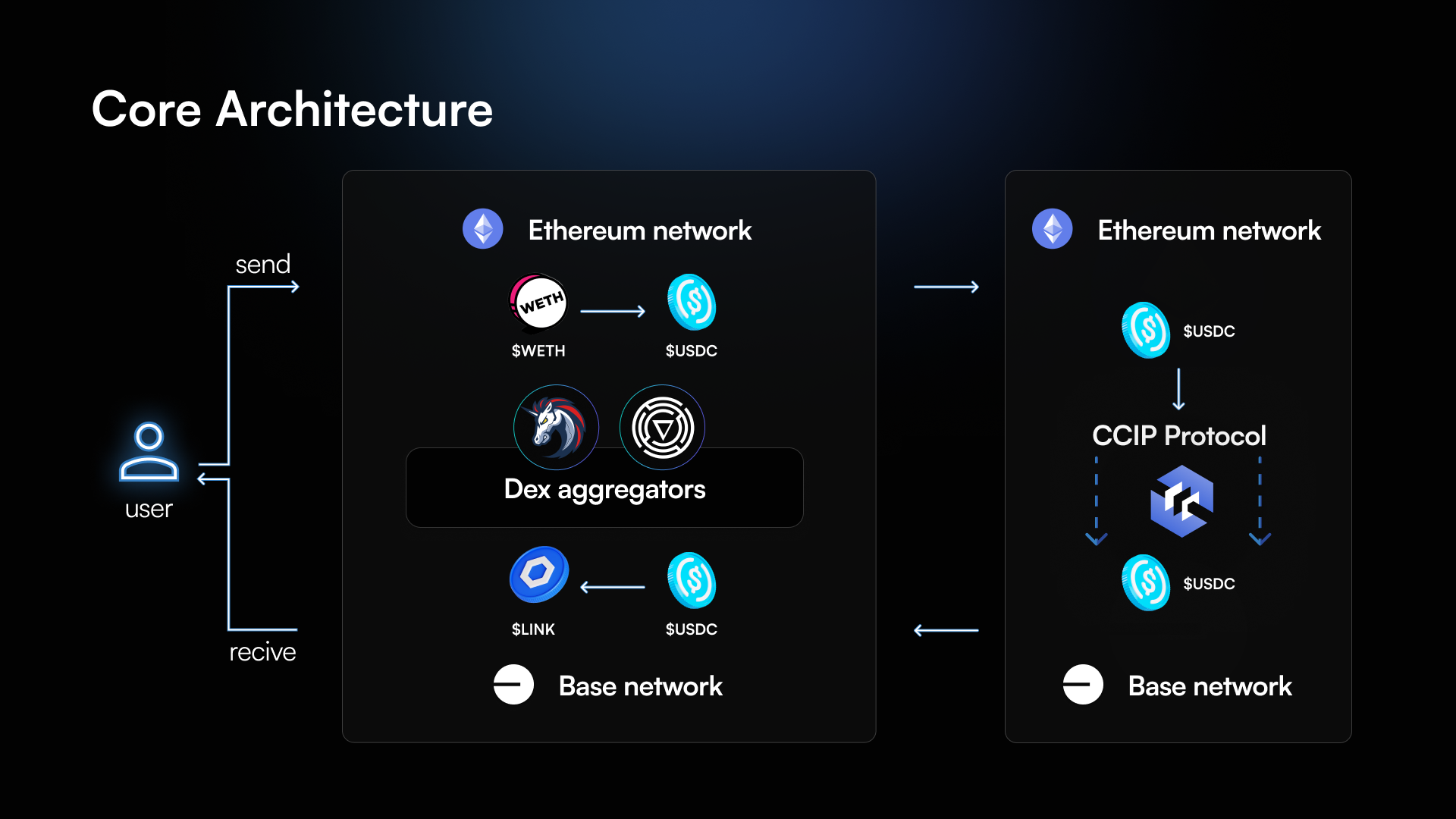

XSwap: Smart Routing & Liquidity Aggregation

XSwap connects liquidity sources across multiple blockchains, ensuring traders get the best price available while minimizing slippage. By leveraging cross-chain liquidity aggregation, users experience more efficient and cost-effective swaps.

3. Security – Protecting Users at Every Step

Traditional DEXs: Risky Bridges & Complex Workarounds

Since single-chain DEXs lack built-in cross-chain functionality, users often rely on bridges—which have been a prime target for hacks, losing billions in stolen assets. Additionally, manually transferring assets between chains exposes traders to phishing scams, fake tokens, and human errors.

XSwap: Chainlink CCIP Security

XSwap removes the need for risky bridges by directly integrating Chainlink CCIP, the most secure cross-chain infrastructure available. This ensures that all cross-chain swaps adhere to institutional-grade security standards, reducing the risk of exploits.

Related: https://blog.xswap.link/how-to-safely-transfer-tokens-across-blockchains-a-cross-chain-guide/

4. User Experience – No More Fragmentation

Traditional DEXs: Friction & Complexity

Navigating multiple blockchains with traditional DEXs requires multiple wallets, bridges, and manual token swaps. This complexity drives many users to centralized exchanges, defeating the purpose of DeFi.

XSwap: One-Click Simplicity

XSwap removes these barriers, providing a seamless, one-step trading experience. Users can swap assets across chains without switching networks or managing multiple wallets, making DeFi as easy as using a centralized platform—but fully decentralized.

Try on: XSwap’s official swap page

Final Thoughts – The Future is Cross-Chain

Traditional DEXs have paved the way for decentralized trading, but they can’t keep up with DeFi’s cross-chain future. XSwap bridges the gap by providing:

• True cross-chain swaps without relying on risky bridges.• Aggregated liquidity for better pricing and lower slippage.• Top-tier security using Chainlink CCIP.• A frictionless user experience, making cross-chain trading simple.

The future of DeFi isn’t siloed. It’s interoperable, secure, and seamless. And XSwap is leading the way.

🔗 Start trading cross-chain now: xswap.link

Stay updated:

Telegram Announcements: https://t.me/xswap_link

Telegram Community: https://t.me/xswap_community